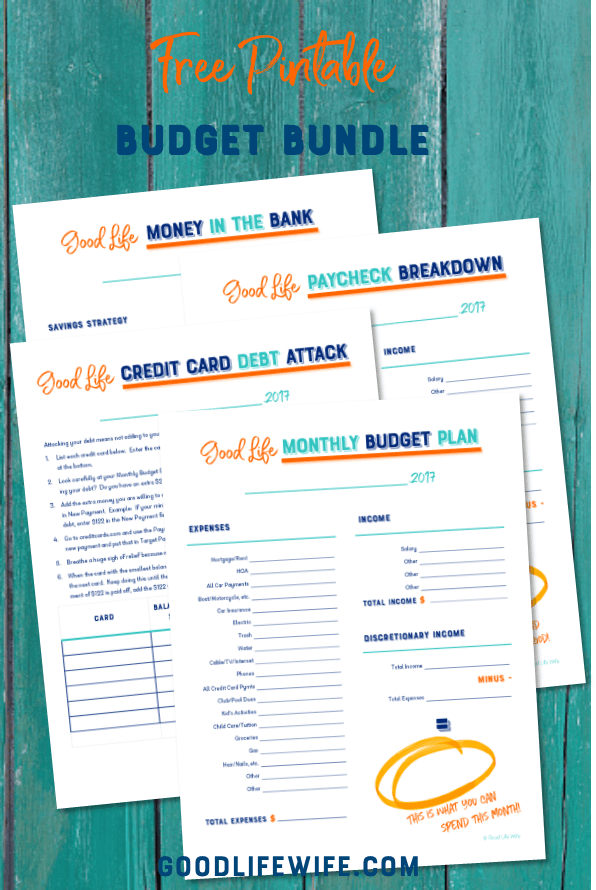

Uugg, just the word, “budget” makes you want to cringe, right? Here’s a cure for your budget planning aches and pains. It’s my super awesome Budget Planning Bundle!

Why Do I Need a Budget, Anyway?

I mean, if you have a bottomless pit of cash, you may not need a budget. But for the rest of us mere mortals, a working budget plan is essential. Having a sound budget helps when something unexpected happens, like a car repair or, ripped from the headlines, a natural disaster. It will give you peace of mind to have a little bit in savings, a plan to pay all of your bills, and even have some left over. Come on, you know it’s the right thing to do!

Enter the super awesome Budget Planning Bundle. Click here for access to the free resource library.

Like Money in the Bank

First, print out Money in the Bank. We’re going to talk about saving money before we talk about spending money. Have you ever heard that you should pay yourself first? Well, you should and putting money into your savings account is how you do it.

Experts recommend that you save 20% of your take-home pay. I agree but I also know that the vast majority of Americans have less than $1000 in their savings accounts. You’re reading this because you want to do better, so let’s start with baby steps. If you’re not saving anything right now, try starting with 5%. It will add up quicker than you think. Let’s fill out the cute little form together…

- Net Income. This means the amount of your paycheck. It will be after they take out taxes and any other deductions. If you get more than one paycheck per month, add them all up and enter that number here.

- Savings. Multiply Net Income by .05 (or 5%) to get the amount that will be transferred to your savings account. If you can save more, do it!

- Now subtract the savings from your net income and you have your monthly income, which you can put in the pretty orange circle.

- Bonus points if you have your savings automatically transferred to your savings account. You won’t even have a chance to miss it!

Amazing! You’re already way more of a financial genius than you were five minutes ago. Let’s keep going.

Monthly Budget Plan

Print out the Monthly Budget Plan if you haven’t already. Pretty sure you did ’cause you could probably guess what was coming. This form is going to be our road map for the month. We’ll list all of our income and all of our expenses here so we have a big picture. Later, we’ll break it down further.

Income

Remember what you wrote in the big orange circle on Money in the Bank, enter that for “Salary” and add any other income that you may have in “Other.” Add all of them together for “Total Income.”

Expenses

I have given you lots of expense categories and have made space for others at the bottom. Enter the total you will spend for the month in each. You need to be really accurate here and very realistic. If you have been spending $300 a week on groceries but you don’t like the way $1200 looks, don’t put $700 in “Groceries.”

If you use online banking, lots of banks allow you to track your spending in different categories, so this may be a resource.

Add up all of the expenses for “Total Expenses.”

Discretionary Income

This means what you have left after you subtract your expenses from your income. This is what you have to spend on other things, like shoes, wine, craft supplies, etc. Enter it in the big orange circle so that it’s really clear.

“Wtf, Kim? I have a negative number in that stupid circle!” Okay, let’s not panic. That isn’t great, but we can work with it. You need to take a good, hard look at your expenses and see where you can trim some fat. There is no magic here, either you have to make more money or spend less.

Could you do your nails at home? I do and it’s not hard at all. (Sorry, nail technicians everywhere!) Could you change your internet package or your cell phone plan so you pay less? If you save a little here and a little there, you can probably get things back on the positive side.

If you have trimmed all that you can and are still upside down, you are going to have to earn more money. There are tons of side hustles on Pinterest you could try. Maybe you could babysit a friend’s kid for a bit. Give it some thought and be creative. It may not change overnight, but if you’re dedicated, you can get on the right track.

Let’s break things down even further so that you will know exactly what’s going on throughout the month.

Paycheck Breakdown

In my family, we get paid every other Thursday, so I make a plan for two paychecks and what I will pay from each. On the glorious months that we get an extra check, I make a separate plan for that. If you get paid more or less frequently in your family, print as many forms as you need per month.

Paycheck No.

Number your paychecks 1, 2, etc. and enter the date that you will get them.

Income

Enter the amount of the check, as well as any other income you will receive during this period. Add together for “Total Income.”

Expenses

Look at the due dates for your expenses. Some will be on the first of the month, some later. My mortgage and car payments are due the first, but most of my other bills are due towards the end of the month, so it makes sense for me to pay my mortgage and car payments out of the first paycheck and utilities, etc. from the second.

Figure out what paycheck it makes sense to pay each of your bills from. If you have too many bills due at the same time, some companies are willing to change your due date. It’s worth asking. Break down how much you spend per pay period on groceries, gas, etc. and enter those amounts on each Paycheck Breakdown.

Make sure that you have each expense listed on the Monthly Budget Plan listed on a Paycheck Breakdown sheet so that everything is accounted for. Add everything up for “Total Expenses.”

Discretionary Income

I bet you know what’s coming, clever girl! Yes, subtract your Total Expenses from your Total Income and voila, you have the amount of money you can spend this pay period. Put it right in the big, fat, orange circle. Now don’t go spending more than is in that orange circle, or you aren’t going to have enough for the next pay period. You have to be strong!

Whew, are y’all as tired as I am? I know that doing all of this for the first time is a lot. I also know that the time spent on figuring all of this stuff out will let you sleep more at night because you won’t be waking up at 2:00 a.m. worrying about how you’re going to pay your rent. You are worth doing this. Your family is worth doing this. I have complete confidence in you!

Even though I religiously follow this program, I still panic occasionally and wonder how the hell I’m going to pay for my daughter’s college. What’s your scariest budget nightmare?

I am definitely printing these out. I need to get a budget together. Way too many credit card debt. Thank you for these! I wanted to let you know I am nominating you for the Blogger Recognition Award. You can read more about it in my post. https://goodlifewife.com/

Thanks! I love reading your posts about wine. I just turned 50 last month and I’m really enjoying the posts about remaining fabulous!

Sorry Kim just left the wrong url..https://justchillinwithcarrieandkat.com/blogger-recognition-award/